Now That You Know Your Number… Let’s Plan to Secure It

The Risk of Running Out of Money

- Many retirees assume their savings will last if they withdraw a certain percentage each yea

- But relying on market-based withdrawals comes with risks:

Turn Your Assets into a Lifetime Paycheck

Rather than worrying about market ups and downs, a better approach is to secure a guaranteed monthly paycheck.

This strategy helps ensure that no matter how long you live, your income is predictable and secure

The right strategy depends on which assets you have today and how they can be optimized.

Key Steps to Securing Your Number

STEP 1

Identify Assets to Fund Your Secure Income Plan

STEP 2

Convert a Portion of Your Savings into a MonthlyPaychec

STEP 3

Optimize Taxes &Inflation Protection

Maximizing Your Social Security Paycheck

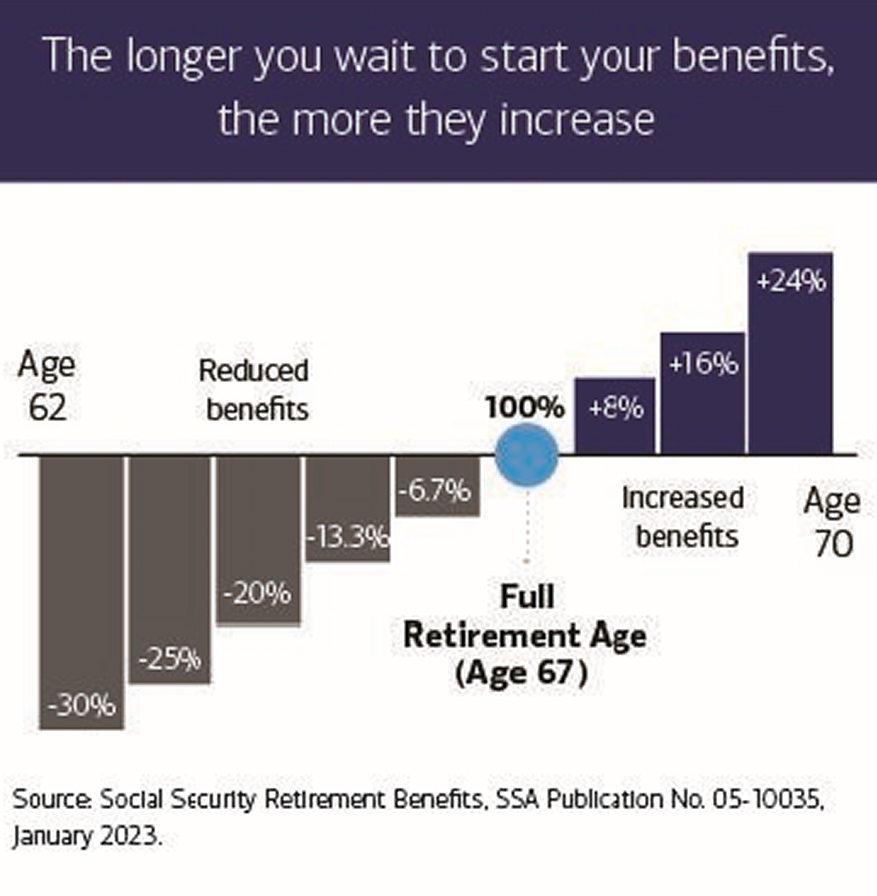

Social Security is your first source of guaranteed income, but claiming it at the wrong time could cost you thousands

Every year you delay claiming Social Security benefits past your Full Retirement Age (FRA) up to age 70, your monthly benefit permanently increases by approximately 8% per year.

The key question: When should YOU claim?

Our licensed insurance professionals can help you understand how income from products like annuities can be coordinated with your Social Security benefits as part of your overall retirement income strategy.

Some Assets Should Fund Retirement, Others Should Be Left as a Legacy

Which assets should you spend first? Which should be preserved?

Assets with built-in guarantees should be used for your monthly paycheck.

Other assets are better left to heirs because of tax advantages